Our Mission

Our mission is to unleash the power of business to help people prosper and the planet thrive. We deliver world-class Education, purposeful Student Work, and Corporate + Community Impact with companies, nonprofits, and government leaders to help solve the world’s most pressing issues.

Guided by our belief that companies succeed by balancing the needs of all stakeholders – communities, customers, employees, suppliers, shareholders, and the planet – we educate and work with students and executives to manage the triple bottom line – people, planet, and profit.

Learn more about OUR WORK

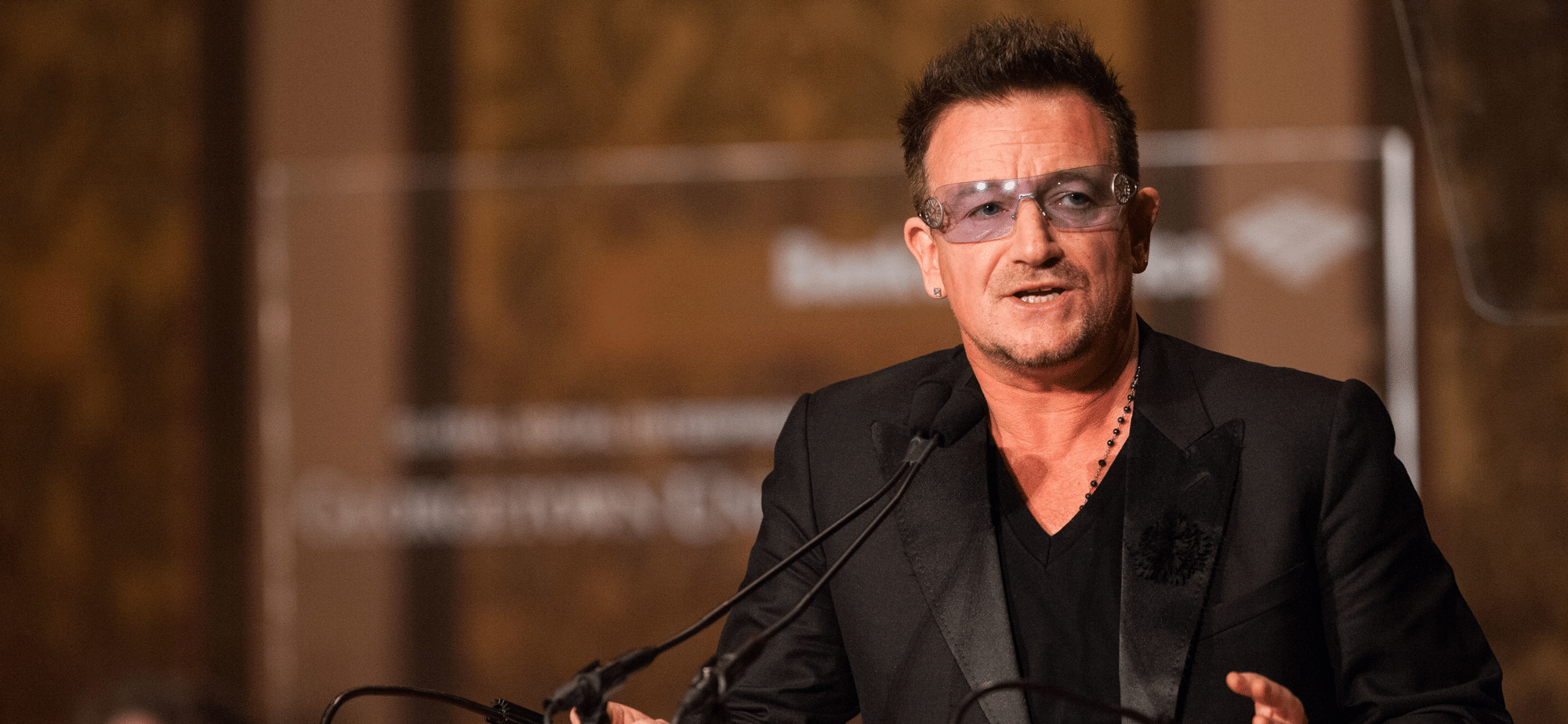

“We want to be the best in the world and best for the world. Business for Impact brings together our university and its students, business, and civil society to benefit the common good.”

Paul Almeida, Dean, McDonough School of Business

See Our Impact

A message from

our leaders